By now, most real estate market observers have noted that it's not a good time to be a realtor. Existing home sales have been on the wane for several consecutive months, driven by a confluence of factors. Tight supply is the main one: homeowners are choosing to hold onto their properties for longer, and new construction isn't enough to keep up with fresh demand from first-time homebuyers. At the same time, put off by rising home prices, people are renting their homes at higher rates than in previous years, with Pew Research noting last year that the share of households that was renting their homes is at a 50-year high. None of this is good news for realtors, who rely on robust home turnover and a deluge of sales to earn their living.

Of all the technology IPOs of last year, none is as dependent on the real estate market as Redfin (NASDAQ:RDFN), the tech-enabled real estate brokerage that makes the bulk of its revenues from realtor commissions. Later this month, we'll come upon the one-year anniversary of Redfin's IPO at $15 per share. Early investors have clearly done well, but as you can see from the chart below, most of the gains in the stock were already had at the beginning of its life as a public company. Over the past few months, Redfin has traded in a jagged pattern without a clear direction.

RDFN data by YCharts

RDFN data by YCharts

Though I previously noted that Redfin might be a buy under $20, at its current share price of ~$24, the stock is slated for a correction - especially with real estate fundamentals so weak. Redfin is incapable of escaping the gravity of the real estate industry, which is encountering its first major stumble since the financial crisis. Unlike last time, the problem is not the hangover effect from a glut of subprime demand - rather, it's limited supply, rising (not falling) prices that are keeping buyers at bay, and a new tax code under the Trump administration that is less favorable to homeowners than before.

To touch on the last point in more detail - as most investors know, the tax reform act increased the standard deduction to $12,000 for individuals, nearly twice what it was before. This means that for the owners or prospective owners of moderately priced homes, the interest tax deduction may no longer be advantageous relative to the standard deduction - eliminating one of the bedrock textbook reasons to buy a home in the United States. The mortgage interest deduction has long been considered a sacred cow of the U.S. tax code, and it has remained in there - but now, it will benefit fewer taxpayers to take advantage of it.

In addition to that, the Trump tax plan also capped state, local, and property tax deductions to just $10,000. For taxpayers in high-tax states like California and New York (we'll touch on the latter in further detail), this makes homeownership even less appealing, as many of them will already be using up the full deduction on state income taxes with nothing left over to deduct for property taxes. Adding insult to injury, the mortgage interest deduction has also been capped to just $750k, or $250k less than the prior cap of $1 million. Unfavorable tax shifts have already hurt the pace of home sales in New York; the same effect is likely to spread into other high-valued coastal markets in which Redfin draws the lion's share of its revenues.

Redfin is up against several structural challenges that may take years to overcome. The company's revenue growth began decelerating last quarter in Q1, and that isn't likely to change when it reports earnings early next month. In three out of three times that Redfin has reported earnings since going public last summer, the stock has fallen by 5% or more - even after beating Wall Street estimates as it did in Q4 and Q1.

In my view, it's not a good time to make a bullish bet on the company. The entire real estate industry is undergoing chills, and Redfin can't do much to deviate from that weakness.

NAR data shows third consecutive month of contraction

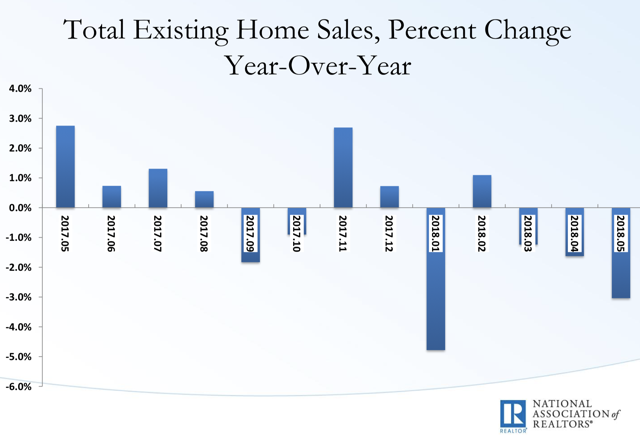

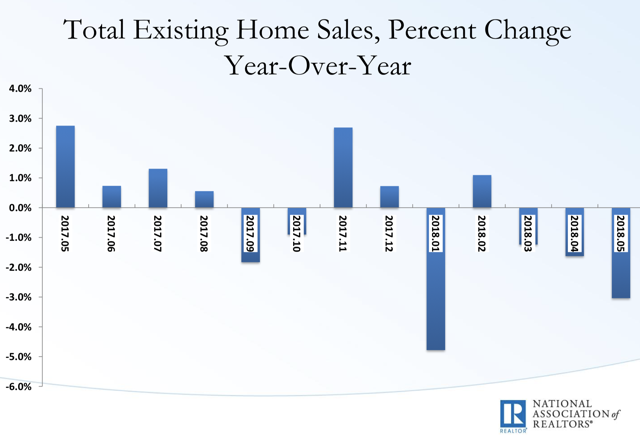

Numerous data points this year have pointed to a slowdown in the housing market, but perhaps none is important as the monthly data package released by the National Association of Realtors (NAR), often considered the authoritative voice on the real estate market.

The data released two weeks ago covered the month of May; later this month, NAR will release data for June. According to NAR, May was the third consecutive month of declines in existing home sales. Sales were down 3% y/y, continuing a trend of protracted weakness in the market since the beginning of the year (January saw the biggest drop, as shown in the monthly chart below):

Figure 1. NAR monthly home sales data

Source: National Association of Realtors

Some other interesting highlights from the NAR report: first-time homebuyers fell to 31% of all existing home sales, down from 33% in the year-ago period. This corroborates the notion that many younger millennials are choosing to rent for longer periods of time before buying their first homes, causing a further lull in the housing market.

NAR's chief economist noted the following in the report:

Incredibly low supply continues to be the primary impediment to more sales, but there��s no question the combination of higher prices and mortgage rates are pinching the budgets of prospective buyers, and ultimately keeping some from reaching the market.��

With prices up, mortgage rates up, and tax code changes all favoring rentals to home-buying, real estate sales (and thus, the lifeblood of realtors and real estate agencies like Redfin) are facing a major threat.

Manhattan

The nation's unofficial capital and most famous real estate market deserves a special mention. As reported by CNBC, a new report from Douglas Elliman proclaimed that Manhattan real estate has had its worst Q2 since the financial crisis.

The island of Manhattan, of course, has long had intricacies and market dynamics that distinguished it from the rest of American real estate. But the freeze in America's largest real estate market certainly puts a damper on forecasts for the rest of the country. According to the report, sales in Manhattan fell 17% y/y in the second quarter (compared to single-digit declines reported in the NAR data for the country as a whole), while the average sale price declined 5% y/y to $2.1 million.

As usual, a number of local factors are to blame, in addition to the countrywide headwinds from the tax code and rising interest rates. The major New York-specific issue is a flood of new supply, particularly in the high-end luxury condo segment, where there is now a 16-month supply inventory (most agree that 5-6 months of supply denotes a healthy supply-demand balance in the real estate sector).

One factor that is often overlooked, however, is a slowdown in foreign buying activity. The Elliman report claims that apartment sales to foreign buyers are down by 40% y/y. This could in part be attributed to the global rout in emerging market stocks, where China's indices have entered into a bear market after falling more than 20% from recent highs. Wealthy foreigners are suddenly feeling less flush and buying fewer trophy properties in leading U.S. cities.

Redfin doesn't break out its revenues by market. Even so, it's fairly easy to judge that Manhattan is one of the company's most important markets and a large source of its revenues. If weakness in Manhattan bleeds over into Redfin's other important expensive coastal markets like San Francisco, San Jose, and Seattle, the company could see its first y/y revenue decline. Redfin has been dropping its listing fee to 1% (versus the 3% industry standard) in many of these high-priced markets in an attempt to win market share, but even these fee reductions might not be enough to stimulate growth if the broader market continues to contract.

Key takeaways

For all the negative noise on the real estate market, Redfin shares haven't dropped nearly enough. It has somewhat been protected by its facade of being a "technology" company, but at the end of the day, Redfin can't escape the fact that real estate sales and agent commissions are down - which are the lifeblood of its business.

Second-quarter earnings are coming up in August, and earnings releases have historically been a hugely negative catalyst for the stock. With most data sources pointing to unusual weakness in the real estate market in Q2, it's almost inevitable that Redfin will also post a disappointing quarter. In my view, it's a good time to exit this trade and stay on the sidelines until the real estate market returns to healthy conditions.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

LuckChain (CURRENCY:BASH) traded flat against the US dollar during the twenty-four hour period ending at 11:00 AM Eastern on July 22nd. LuckChain has a total market capitalization of $2.95 million and $0.00 worth of LuckChain was traded on exchanges in the last day. In the last week, LuckChain has traded up 18.6% against the US dollar. One LuckChain coin can now be purchased for about $0.0041 or 0.00000061 BTC on exchanges including YoBit and C-CEX.

LuckChain (CURRENCY:BASH) traded flat against the US dollar during the twenty-four hour period ending at 11:00 AM Eastern on July 22nd. LuckChain has a total market capitalization of $2.95 million and $0.00 worth of LuckChain was traded on exchanges in the last day. In the last week, LuckChain has traded up 18.6% against the US dollar. One LuckChain coin can now be purchased for about $0.0041 or 0.00000061 BTC on exchanges including YoBit and C-CEX.  News articles about OncoSec Medical (NASDAQ:ONCS) have been trending somewhat positive this week, Accern Sentiment Analysis reports. Accern identifies positive and negative media coverage by reviewing more than twenty million blog and news sources in real-time. Accern ranks coverage of companies on a scale of negative one to one, with scores nearest to one being the most favorable. OncoSec Medical earned a news sentiment score of 0.09 on Accern’s scale. Accern also assigned media coverage about the biotechnology company an impact score of 43.2515581770241 out of 100, indicating that recent media coverage is somewhat unlikely to have an impact on the stock’s share price in the next several days.

News articles about OncoSec Medical (NASDAQ:ONCS) have been trending somewhat positive this week, Accern Sentiment Analysis reports. Accern identifies positive and negative media coverage by reviewing more than twenty million blog and news sources in real-time. Accern ranks coverage of companies on a scale of negative one to one, with scores nearest to one being the most favorable. OncoSec Medical earned a news sentiment score of 0.09 on Accern’s scale. Accern also assigned media coverage about the biotechnology company an impact score of 43.2515581770241 out of 100, indicating that recent media coverage is somewhat unlikely to have an impact on the stock’s share price in the next several days.  Analysts forecast that SAP SE (NYSE:SAP) will post sales of $7.11 billion for the current quarter, according to Zacks. Six analysts have made estimates for SAP’s earnings, with the highest sales estimate coming in at $7.23 billion and the lowest estimate coming in at $6.94 billion. SAP reported sales of $6.36 billion in the same quarter last year, which would suggest a positive year over year growth rate of 11.8%. The business is expected to announce its next quarterly earnings report before the market opens on Thursday, July 19th.

Analysts forecast that SAP SE (NYSE:SAP) will post sales of $7.11 billion for the current quarter, according to Zacks. Six analysts have made estimates for SAP’s earnings, with the highest sales estimate coming in at $7.23 billion and the lowest estimate coming in at $6.94 billion. SAP reported sales of $6.36 billion in the same quarter last year, which would suggest a positive year over year growth rate of 11.8%. The business is expected to announce its next quarterly earnings report before the market opens on Thursday, July 19th.

RDFN data by YCharts

RDFN data by YCharts